Want to speak with an expert broker?

The EZ Finance Blog

The latest financial news, hints and tips for Aussie small business

Unsecured Finance - The Nitty Gritty

Without access to large assets to be used as collateral (secured loan) then unsecured finance could be the solution you’re looking for, particularly as a start-up or small business.

We go through more in our FREE Financial Survivors Guide for ABN holders you can download for free here - Click Here

An unsecured business loan allows you to borrow funds without providing security.

Even if you do have assets, you may not want to put them in the firing line. Also keeping clear lines between personal and business finance might be a smart way to go, depending on the nature of your business.

Enter stage left…this is where unsecured lending comes in.

There is added risk for lenders with unsecured finance. As a result, you can typically expect higher interest rates.

However, the process of applying for unsecured finance (vs. secure) may save you hours and hours of paperwork and chasing up the necessary documentation…

It’s the perfect option for businesses who need cash quickly, don’t like the idea of risking their assets, or simply don’t have much to put up as security anyhow.

Contributing factors to being successful with unsecured finance include your overall credit worth, time spent operating in business, as well as the financial health, nature and industry of

your business.

Lenders specifically evaluate the following:

-Credit Score

-Time Trading

-Position with the ATO

-Property Ownership

-Balance Sheet

-Repayment History

-Cash Flow Trends

-Income Sources

-Month on Month Sales

-Industry

-Deposits

-Average Cash Balance

Wondering if you qualify?

Your ability to run a profitable business doesn’t necessarily guarantee you will be successful in applying for funds, although it will cast you in a favourable light. As long as you’re not going backwards, and are meeting your repayment obligations, then there is a good chance your application will be successful. (especially more so with non-bank lenders)

What else can help your application be successful?

You want to see ‘Green flags’ (instead of a white one!) as so does the lender.

In particular, lenders love to see multiple directors and / or shareholders, as well as property-backed guarantees. Call it uncertain economic times!

And with low doc loans, only bank statements are assessed and usually your BAS (Business Activity Statements). So more often than not, approval will be based on cash flow and ability to make timely repayments.

Applying for larger loans will not only require bank statements, but other financials including your Profit & Loss Statement (P&L) and Balance Sheet.

In addition, improving the health of your credit score (if it needs it) is the most important thing you can do to increase your chances of approval. It’s all about healthy financial habits.

In this case, past performance IS KEY indication of future performance!

Why are unsecured business loans declined?

Usually by having anything untoward on your credit file (personal or business) - such as a default payment or a court judgement, will more often than not lead your application to being declined.

We recommend getting in touch with a reputable credit reporting agency in Australia.

eg. Equifax, Illion, Experian...

This will give you a snapshot of your credit history through a report, which you can give to us to help assess your situation and eligibility for getting finance approved.

Why don’t you speak with us today about how much you’re looking to borrow?

Get in touch with EZ Finance today.

We help you secure finance the EZ way!

By Phil Rice

CEO EZ Finance

Like the article? Share across your favourite platform...

EXPLORE OUR LATEST BLOG POSTS

When the pandemic started in 2020, Tax Laws changed and the ATO stopped chasing debt. As the economy...

Author | Phil Rice

CEO EZ Finance

Over one-third of Australian SMEs are open to exploring their funding options with non-traditional lenders, according to a new...

Author | Phil Rice

CEO EZ Finance

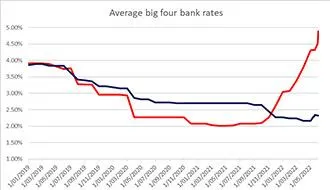

Rates are set to rise, which means businesses should secure funding sooner rather than later to lock in a great deal...

Author | Phil Rice

CEO EZ Finance

The results of a recent survey conducted by the Australian Bureau of Statistics showed financial stress in Australian households...

Author | Phil Rice

CEO EZ Finance

Corporate watchdog ASIC has urged small businesses to be vigilant about payment redirection scams after the Australian...

Author | Phil Rice

CEO EZ Finance

The Australian Small Business and Family Enterprise Ombudsman estimates the nation’s 2.3 million small businesses...

Author | Phil Rice

CEO EZ Finance

Without access to large assets to be used as collateral (secured loan) then unsecured finance could be the solution you’re...

Author | Phil Rice

CEO EZ Finance

You are going to need to provide documentation, applying for any sort of loan. No matter what type of...

Author | Phil Rice

CEO EZ Finance

Pre-Fight Considerations (Pound for Pound!) 1. Costs. It's not free to borrow money, so it is important to weigh up all...

Author | Phil Rice

CEO EZ Finance

You may already have a loan. That’s great! But whether we’re talking about commercial or residential property...

Author | Phil Rice

CEO EZ Finance

Nope! This is one of the easy ways the big banks attract customers and line they're greedy pockets. The cheapest option...

Author | Phil Rice

CEO EZ Finance

A strong theme is emerging from two consecutive years of Small Business Owner research according to various studies...

Author | Phil Rice

CEO EZ Finance

WE HELP BUSINESSES LIKE YOURS FIND FUNDING EVERY DAY!

A FEW OF OUR APPROVED LENDING PARTNERS

ABN Holders... Let's find your perfect match with our quick Grants and Loans search today! It's FREE and takes less than 2mins...

Your information is confidential to us. We NEVER rent, sell or share your info. We ONLY notify you with verified financial information to meet your needs + You can unsubscribe at any time 👍🏻

This page provides general information only and should not be used or interpreted as specific advice for your individual circumstances. Please seek specific advice about your finance needs from a Certified Credit Advisor. All finance applications are assessed on the individual applicants current financial circumstances which will reflect the interest rate offered by our panel of lenders. All loan applications are subject to the lenders lending parameters, terms and conditions.

EZFinance Pty Ltd. ACN:140178383 - Australian Credit Licence Number (ACL): 392611 and it's authorised Advisors are fully qualified to give advice and assist with all/any consumer lending. EZFinance Pty Ltd is a member of AFCA. EZFinance Commercial Pty Ltd (ACN:639833604) and it's authorised advisors are fully qualified to give advice and assist with all/any Commercial / Business lending. EZFinance Commercial Pty Ltd only advise and assist with "Non-Coded" finance (as described in the NCCP act 2009) and are not a member of AFCA.

EZ Finance Pty Ltd © Copyright 2022 All Rights Reserved | Privacy Policy