Want to speak with an expert broker?

The EZ Finance Blog

The latest financial news, hints and tips for Aussie small business

Ultimate Showdown: Cash vs. Credit

Pre-Fight Considerations (Pound for Pound!)

Costs

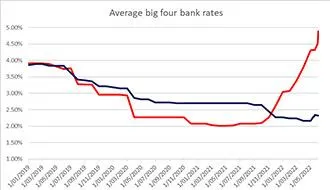

It's not free to borrow money, so it is important to weigh up all the costs involved. Getting the lowest rate does not automatically mean you have the cheapest loan to service. There are often hidden costs, through different fees and charges, that contribute to the overall cost of your loan. (read the small print!)

Banks are businesses too, and this is how they make money. However we are experts at reading and understanding the way banks outline their costs, and can help you make the best decision.

Securing Finance

To secure finance, you will need to put up eligible assets as collateral. More often than not, this will be an existing property, vehicle, equipment or existing funds. In case you default on repayments, the lender will use these assets to recover any losses that may occur as a result of defaulting. However, opting for secured finance can improve your chances of being successful in your application.

If it is not possible to secure finance, you will need to either take out unsecured finance or use existing funds as collateral. There may be options available to you that you have not yet considered or as yet are unaware of.

Accessing Finance is Tough

With access to over 120 lenders Australia wide, we are able to negotiate on your behalf and produce the best options for you to consider when taking out finance. This includes taking care of all the paperwork and headaches along the way, ensuring you tick all the boxes when it comes to making a successful application and securing critical funding for your business.

If you have applied for a loan in the past, you will know that it can be a difficult task. There are a number of hoops to jump through when it comes to the application process. You need someone in your corner who understands the ins and outs of how to be successful, an expert in the field of finance and who truly cares and understands your needs as a business owner.

Reasons to Get in the Ring and Secure Finance (Round for Round!)

A stronger position long-term for your business

Everyone's situation is different. You need room to grow your business. Making the decision to get a loan is a good start, as it will help project your business forward.

If you don't finance your business properly, you could risk a healthy growth rate early on and will need to dedicate more personal time and energy over the longer term. So the cost of inaction could actually be far more expensive.

Establishing your business with financial backing can quickly set the foundations needed for long term success, and drastically improve your chance of dealing that industry knockout blow!

Predictable Cashflow

By maintaining a cash buffer, and knowing if there’s a deficit that you’re covered, you can relieve any worry and stress of maintaining your financial position which in turn helps you focus on your business. Since anxiety over finances can potentially have negative consequences on day to day operations.

Fatigue is a common condition of burnt out business owners, and if you add a splash of financial stress, you're not in for an enjoyable ride. Having a loan in place will not only give you peace of mind, but can significantly contribute to a positive mindset. Call it the placebo effect!

Improve on Credit History

Prove you’re worthy when it comes to credit, and if your track record shows you are responsible when it comes to managing funds, this will reflect in your ability to secure finance. Showing you’re responsible to lenders will allow you to be successful in your credit application and ensure a smoother process.

If there happens to be any black marks against your credit history (no judgements here!) it may be a matter of shining the best light on your circumstances. Speak with us about your situation today, we can equip you with the right information, and get the ball rolling in the right direction for you.

Minimise Tax

Spend money to make money, as the old saying goes. If your business is in need of assets that are core to your operations, such as a new vehicle, plant and equipment, or machinery - then financing can help dramatically reduce your tax liabilities.

The instant asset write off is one example, and how you can leverage tax incentives to the best effect will always depend on your situation. As a side note, the interest amount payable on a business loan is mostly always tax deductible.

Quicker Access to Funds

This is especially important in an emergency, when the unforeseen occurs or when circumstances dictate. If you don’t have enough funds available, then your only option may be unsecured finance to make up the difference. New loan approval can be secured in less than 24 hours, especially if we’re talking about unsecured loans, since there is no security required.

Let’s Rumble!

Cash and credit both have their advantages and disadvantages, and finding the right solution for your situation can depend on a number of factors. There isn’t necessarily a right or wrong way, so getting expert advice on financial decisions is key.

Get in touch with us today. EZ Finance can give you a no-obligation call back and free advice. And if we can help you? We’ll be there in the ring with you, doing the heavy lifting, patting you on the back, and helping you put your best foot forward to win the fight!

By Phil Rice

CEO EZ Finance

Like the article? Share across your favourite platform...

EXPLORE OUR LATEST BLOG POSTS

When the pandemic started in 2020, Tax Laws changed and the ATO stopped chasing debt. As the economy...

Author | Phil Rice

CEO EZ Finance

Over one-third of Australian SMEs are open to exploring their funding options with non-traditional lenders, according to a new...

Author | Phil Rice

CEO EZ Finance

Rates are set to rise, which means businesses should secure funding sooner rather than later to lock in a great deal...

Author | Phil Rice

CEO EZ Finance

The results of a recent survey conducted by the Australian Bureau of Statistics showed financial stress in Australian households...

Author | Phil Rice

CEO EZ Finance

Corporate watchdog ASIC has urged small businesses to be vigilant about payment redirection scams after the Australian...

Author | Phil Rice

CEO EZ Finance

The Australian Small Business and Family Enterprise Ombudsman estimates the nation’s 2.3 million small businesses...

Author | Phil Rice

CEO EZ Finance

Without access to large assets to be used as collateral (secured loan) then unsecured finance could be the solution you’re...

Author | Phil Rice

CEO EZ Finance

You are going to need to provide documentation, applying for any sort of loan. No matter what type of...

Author | Phil Rice

CEO EZ Finance

Pre-Fight Considerations (Pound for Pound!) 1. Costs. It's not free to borrow money, so it is important to weigh up all...

Author | Phil Rice

CEO EZ Finance

You may already have a loan. That’s great! But whether we’re talking about commercial or residential property...

Author | Phil Rice

CEO EZ Finance

Nope! This is one of the easy ways the big banks attract customers and line they're greedy pockets. The cheapest option...

Author | Phil Rice

CEO EZ Finance

A strong theme is emerging from two consecutive years of Small Business Owner research according to various studies...

Author | Phil Rice

CEO EZ Finance

WE HELP BUSINESSES LIKE YOURS FIND FUNDING EVERY DAY!

A FEW OF OUR APPROVED LENDING PARTNERS

Let's find your perfect match with our quick Grants and Loans search today! It's FREE and takes less than 2mins...

Your information is confidential to us. We NEVER rent, sell or share your info. We ONLY notify you with verified financial information to meet your needs + You can unsubscribe at any time 👍🏻

This page provides general information only and should not be used or interpreted as specific advice for your individual circumstances. Please seek specific advice about your finance needs from a Certified Credit Advisor. All finance applications are assessed on the individual applicants current financial circumstances which will reflect the interest rate offered by our panel of lenders. All loan applications are subject to the lenders lending parameters, terms and conditions.

EZFinance Pty Ltd. ACN:140178383 - Australian Credit Licence Number (ACL): 392611 and it's authorised Advisors are fully qualified to give advice and assist with all/any consumer lending. EZFinance Pty Ltd is a member of AFCA. EZFinance Commercial Pty Ltd (ACN:639833604) and it's authorised advisors are fully qualified to give advice and assist with all/any Commercial / Business lending. EZFinance Commercial Pty Ltd only advise and assist with "Non-Coded" finance (as described in the NCCP act 2009) and are not a member of AFCA.

EZ Finance Pty Ltd © Copyright 2022 All Rights Reserved | Privacy Policy