Want to speak with an expert broker?

The EZ Finance Blog

The latest financial news, hints and tips for Aussie small business

Finance is available to Business owners, if you know where to look!

The Australian Small Business and Family Enterprise Ombudsman estimates the nation’s 2.3 million small businesses (with less than 20 employees) represent about 98% of all businesses in Australia. That’s a massive customer base and one that is eager for new funding options.

One business lender’s September 2021 SME Growth Index shows that two in every three SMEs (66.1%) sourced new funding options during the past year. Of those surveyed, 38% applied for asset and equipment finance, 16.3% sourced new invoice finance, 15.9% sought a new secured bank loan, and 8.8% borrowed from an online fintech.

The reasons for the new funds varied. The majority of businesses (57.5%) allocated the finance to capital expenditure to purchase plant and equipment, while 40.6% used it to improve cash flow. A third (34.3%) paid down debt, 29.3% used the funds to secure large projects or clients, 20.2% wanted to expand capacity, 16.6% refinanced existing loans, 15.1% wanted to hire staff or upskill existing staff, and 7.1% used the funds to enter new markets or create new products.

The top five sectors securing finance through another business lender are construction, accommodation and food services, retail trade, professional services and manufacturing, and this hasn’t changed in the last two years.

Business Lenders concur that almost 40% of small businesses require access to an average of $47,000 in finance.

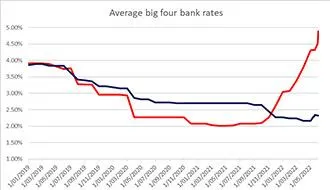

They find that many businesses require funds to cover assets, purchase additional inventory, or fund further digital transformations after lockdown. We’re also seeing business owners looking for fixed rates for short-term loans before interest rates start to climb.

For small Business owners, access to capital is considered vital, with 87% of small business respondents reporting that they would miss opportunities without it.The pandemic has highlighted the importance of SMEs having solid cash flow to help deal with unforeseen events.

Managing cash flow is one of SMEs’ top challenges, and it’s common that gaps may need to be filled to cover temporary shortfalls or investments to support growth.Lockdowns and restrictions have made it hard for SMEs to report accurately on their performance, resulting in lenders declining finance or making the submission process lengthy and frustrating.

Some alternate business Lenders products help remove this barrier by only requiring a self-certified income declaration and one other form of documentation (accountant’s letter, last two BAS, or six months’ bank statements) to support current income.

Market research shows that one in four small businesses are rejected for finance by a mainstream bank, and as many as 25% of those approved for loans report delays in the lending process that have negatively affected their businesses.

With access to over 120 banks and finance Lenders, and thousands of finance products, EZ Finance is your “Go-To” place for appropriate financing and quick solutions for all your finance needs.

By Phil Rice

CEO EZ Finance

Like the article? Share across your favourite platform...

EXPLORE OUR LATEST BLOG POSTS

When the pandemic started in 2020, Tax Laws changed and the ATO stopped chasing debt. As the economy...

Author | Phil Rice

CEO EZ Finance

Over one-third of Australian SMEs are open to exploring their funding options with non-traditional lenders, according to a new...

Author | Phil Rice

CEO EZ Finance

Rates are set to rise, which means businesses should secure funding sooner rather than later to lock in a great deal...

Author | Phil Rice

CEO EZ Finance

The results of a recent survey conducted by the Australian Bureau of Statistics showed financial stress in Australian households...

Author | Phil Rice

CEO EZ Finance

Corporate watchdog ASIC has urged small businesses to be vigilant about payment redirection scams after the Australian...

Author | Phil Rice

CEO EZ Finance

The Australian Small Business and Family Enterprise Ombudsman estimates the nation’s 2.3 million small businesses...

Author | Phil Rice

CEO EZ Finance

Without access to large assets to be used as collateral (secured loan) then unsecured finance could be the solution you’re...

Author | Phil Rice

CEO EZ Finance

You are going to need to provide documentation, applying for any sort of loan. No matter what type of...

Author | Phil Rice

CEO EZ Finance

Pre-Fight Considerations (Pound for Pound!) 1. Costs. It's not free to borrow money, so it is important to weigh up all...

Author | Phil Rice

CEO EZ Finance

You may already have a loan. That’s great! But whether we’re talking about commercial or residential property...

Author | Phil Rice

CEO EZ Finance

Nope! This is one of the easy ways the big banks attract customers and line they're greedy pockets. The cheapest option...

Author | Phil Rice

CEO EZ Finance

A strong theme is emerging from two consecutive years of Small Business Owner research according to various studies...

Author | Phil Rice

CEO EZ Finance

WE HELP BUSINESSES LIKE YOURS FIND FUNDING EVERY DAY!

A FEW OF OUR APPROVED LENDING PARTNERS

Let's find your perfect match with our quick Grants and Loans search today! It's FREE and takes less than 2mins...

Your information is confidential to us. We NEVER rent, sell or share your info. We ONLY notify you with verified financial information to meet your needs + You can unsubscribe at any time 👍🏻

This page provides general information only and should not be used or interpreted as specific advice for your individual circumstances. Please seek specific advice about your finance needs from a Certified Credit Advisor. All finance applications are assessed on the individual applicants current financial circumstances which will reflect the interest rate offered by our panel of lenders. All loan applications are subject to the lenders lending parameters, terms and conditions.

EZFinance Pty Ltd. ACN:140178383 - Australian Credit Licence Number (ACL): 392611 and it's authorised Advisors are fully qualified to give advice and assist with all/any consumer lending. EZFinance Pty Ltd is a member of AFCA. EZFinance Commercial Pty Ltd (ACN:639833604) and it's authorised advisors are fully qualified to give advice and assist with all/any Commercial / Business lending. EZFinance Commercial Pty Ltd only advise and assist with "Non-Coded" finance (as described in the NCCP act 2009) and are not a member of AFCA.

EZ Finance Pty Ltd © Copyright 2022 All Rights Reserved | Privacy Policy