Want to speak with an expert broker?

The EZ Finance Blog

The latest financial news, hints and tips for Aussie small business

Does the lowest interest rate always equal best value?

Short answer? Nope! It doesn't equal best value... heres why:

This is one of the easy ways the big banks attract customers and line their greedy pockets…

The cheapest option isn’t always the lowest rate. It’s the advertised rate that is used to suck you in!

We go through more in our FREE Financial Survivors Guide for ABN holders you can download instantly - (no details needed)

CLICK HERE - to download

Quick recap on how interest rates work:

A loan is made up for principal and interest. The principal is the amount of funds borrowed. The interest is the fee charged in exchange for borrowing the funds.

The interest rate (alongside other fees and charges) determines how much you pay over the duration of your loan.

This is how lenders make money, and also reduce the risk involved in lending money.

So what can impact the interest rate and/or repayments?

Your Credit Report

New lending parameters are now in force around how to determine interest rates for car and personal loans. The better your credit rating, the lower the interest rate. People are now rewarded for having a good credit report and being responsible with credit.

Vehicle age

A brand new vehicle from a dealer will always attract a better interest rate as it represents a lower risk to the bank. (eg: the security vehicle is in better condition and won’t break down, PLUS, if the bank takes possession of the vehicle, they will be able to sell it easier)

Green Vehicles

Battery or hybrid vehicles are also viewed as a good option by some banks and lenders and they reward the purchaser with a lower interest rate to “save the planet”.

Balloon Payment

A balloon payment is a lump sum payment you pay at the end of the loan contract. The higher the balloon payment, the lower the monthly repayments. Normally, a balloon payment is only offered for a new vehicle or near new vehicle.

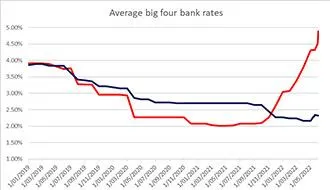

The Current Market

Interest rates will typically drop when times are tough and (touch wood) during a recession. Likewise, interest rates will often be higher in a strong economy.

Business Health

The better your business is performing and the stronger your track record is, the more lenders will view your business favourably. This will include profitability, gross profit, and other financials.

Trading History

The more established your business is over time, is again something lenders look at.

Time spent trading as a profitable business indicates you are financially responsible and a good investment of funds, from the lender’s perspective you’re more likely to make payments on time and without defaults.

Terms and Conditions

When something is too good to be true, it usually is!

The lowest interest rate will usually be accompanied by ongoing fees and charges, or has less flexible terms (or both!). This is where it pays to read the fine print and take into consideration all of the factors which contribute to the cost of taking out a loan.

Asset Collateral

As a borrower, this can be used to reduce your risk. Once secured against your loan, the lender will use assets as a last resort to recover any losses in the event of a loan default. The lender will value the assets during the application process.

Choosing your lender

Exactly like shopping around at the supermarket, the same product will be available but slightly vary in price and ingredients, depending on where you shop.

Big banks usually offer lower interest rates, since their costs are lower and they depend on volume. They also have stricter approval and mostly accept only lower risk customers.

On the other hand, smaller banks and non-bank lenders usually offer higher interest rates in exchange for more lenient approval. This comes with a shorter application process and greater flexibility.

What does this all mean for you?

You need the help of an expert. Somebody who eats this stuff up for breakfast!

Get in touch with EZ Finance today.

We can give you a no-obligation call back whenever it’s convenient for you.

And if we can’t help you (this is rare) you’ve gotten yourself some free advice from a friendly broker you can trust.

By Phil Rice

CEO EZ Finance

Like the article? Share across your favourite platform...

EXPLORE OUR LATEST BLOG POSTS

When the pandemic started in 2020, Tax Laws changed and the ATO stopped chasing debt. As the economy...

Author | Phil Rice

CEO EZ Finance

Over one-third of Australian SMEs are open to exploring their funding options with non-traditional lenders, according to a new...

Author | Phil Rice

CEO EZ Finance

Rates are set to rise, which means businesses should secure funding sooner rather than later to lock in a great deal...

Author | Phil Rice

CEO EZ Finance

The results of a recent survey conducted by the Australian Bureau of Statistics showed financial stress in Australian households...

Author | Phil Rice

CEO EZ Finance

Corporate watchdog ASIC has urged small businesses to be vigilant about payment redirection scams after the Australian...

Author | Phil Rice

CEO EZ Finance

The Australian Small Business and Family Enterprise Ombudsman estimates the nation’s 2.3 million small businesses...

Author | Phil Rice

CEO EZ Finance

Without access to large assets to be used as collateral (secured loan) then unsecured finance could be the solution you’re...

Author | Phil Rice

CEO EZ Finance

You are going to need to provide documentation, applying for any sort of loan. No matter what type of...

Author | Phil Rice

CEO EZ Finance

Pre-Fight Considerations (Pound for Pound!) 1. Costs. It's not free to borrow money, so it is important to weigh up all...

Author | Phil Rice

CEO EZ Finance

You may already have a loan. That’s great! But whether we’re talking about commercial or residential property...

Author | Phil Rice

CEO EZ Finance

Nope! This is one of the easy ways the big banks attract customers and line they're greedy pockets. The cheapest option...

Author | Phil Rice

CEO EZ Finance

A strong theme is emerging from two consecutive years of Small Business Owner research according to various studies...

Author | Phil Rice

CEO EZ Finance

WE HELP BUSINESSES LIKE YOURS FIND FUNDING EVERY DAY!

A FEW OF OUR APPROVED LENDING PARTNERS

Let's find your perfect match with our quick Grants and Loans search today! It's FREE and takes less than 2mins...

Your information is confidential to us. We NEVER rent, sell or share your info. We ONLY notify you with verified financial information to meet your needs + You can unsubscribe at any time 👍🏻

This page provides general information only and should not be used or interpreted as specific advice for your individual circumstances. Please seek specific advice about your finance needs from a Certified Credit Advisor. All finance applications are assessed on the individual applicants current financial circumstances which will reflect the interest rate offered by our panel of lenders. All loan applications are subject to the lenders lending parameters, terms and conditions.

EZFinance Pty Ltd. ACN:140178383 - Australian Credit Licence Number (ACL): 392611 and it's authorised Advisors are fully qualified to give advice and assist with all/any consumer lending. EZFinance Pty Ltd is a member of AFCA. EZFinance Commercial Pty Ltd (ACN:639833604) and it's authorised advisors are fully qualified to give advice and assist with all/any Commercial / Business lending. EZFinance Commercial Pty Ltd only advise and assist with "Non-Coded" finance (as described in the NCCP act 2009) and are not a member of AFCA.

EZ Finance Pty Ltd © Copyright 2022 All Rights Reserved | Privacy Policy