Want to speak with an expert broker?

The EZ Finance Blog

The latest financial news, hints and tips for Aussie small business

If You Need Some Finance - Get It Now!

Rates are set to rise, which means businesses should secure funding sooner rather than later to lock in a great deal.

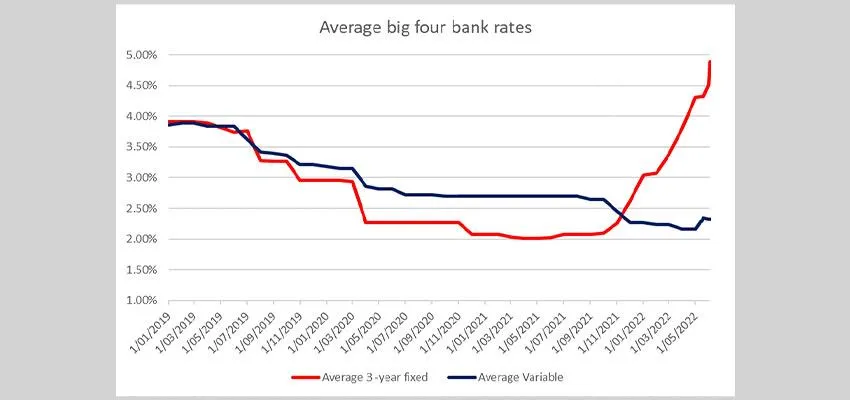

Home Loan Interest rates are starting to rise.

The RBA recently announced the first rate rises we’ve seen in years, and according to Westpac Chief Economist Bill Evans they’re just the beginning. Five further increases have been predicted between June and November to take the cash rate from 0.1% last April to 1.5% by the end of the year. And he expects a further two increases next February and March to take the official cash rate to a peak of two percent in 2023.

Car loans and business loans are also on the UP!

Lenders have been preparing for some time now, with the Asset Finance market starting to increase their rates from the end of 2021. As an example, if we look at the top 15 lenders on our panel, more than 85% increased their pricing at least once over the past few months.

We’ve seen increases from 0.25% to 1.5%, and the lowest rate we could offer in this space went up from 2.9% to 3.49% since the trend started.

Business working capital is preparing to follow

In the working capital space, we haven't seen a price movement in response to the predicted rate increase as yet, however, we have started to see policy changes. As an example, we have lenders moving from a fixed rate to a fixed rate plus the RBA’s interest rate so they can pass any future rate rises onto their customers.

How might this impact small business owners?

In response to cash rate changes, the lending rate for small businesses rises more quickly than it falls. Predictions say that the cash rate will keep increasing up to 1.5% or 2% in 2023/24. This means it’s better for business owners to secure a loan sooner rather than later, to fix the total interest they’ll pay.

As an example, customers could be paying between $1,800 and $2,550 extra interest on a $60,000 loan if they don’t secure a loan before the forecasted rate rises.

Contact EZ Finance NOW! Diverse and appropriate finance solutions are only a phone call away. Get the right finance advice and access over 120 banks and Lenders on our platform, to secure the right finance solution for your business.

By Phil Rice

CEO EZ Finance

Like the article? Share across your favourite platform...

EXPLORE OUR LATEST BLOG POSTS

When the pandemic started in 2020, Tax Laws changed and the ATO stopped chasing debt. As the economy...

Author | Phil Rice

CEO EZ Finance

Over one-third of Australian SMEs are open to exploring their funding options with non-traditional lenders, according to a new...

Author | Phil Rice

CEO EZ Finance

Rates are set to rise, which means businesses should secure funding sooner rather than later to lock in a great deal...

Author | Phil Rice

CEO EZ Finance

The results of a recent survey conducted by the Australian Bureau of Statistics showed financial stress in Australian households...

Author | Phil Rice

CEO EZ Finance

Corporate watchdog ASIC has urged small businesses to be vigilant about payment redirection scams after the Australian...

Author | Phil Rice

CEO EZ Finance

The Australian Small Business and Family Enterprise Ombudsman estimates the nation’s 2.3 million small businesses...

Author | Phil Rice

CEO EZ Finance

Without access to large assets to be used as collateral (secured loan) then unsecured finance could be the solution you’re...

Author | Phil Rice

CEO EZ Finance

You are going to need to provide documentation, applying for any sort of loan. No matter what type of...

Author | Phil Rice

CEO EZ Finance

Pre-Fight Considerations (Pound for Pound!) 1. Costs. It's not free to borrow money, so it is important to weigh up all...

Author | Phil Rice

CEO EZ Finance

You may already have a loan. That’s great! But whether we’re talking about commercial or residential property...

Author | Phil Rice

CEO EZ Finance

Nope! This is one of the easy ways the big banks attract customers and line they're greedy pockets. The cheapest option...

Author | Phil Rice

CEO EZ Finance

A strong theme is emerging from two consecutive years of Small Business Owner research according to various studies...

Author | Phil Rice

CEO EZ Finance

WE HELP BUSINESSES LIKE YOURS FIND FUNDING EVERY DAY!

A FEW OF OUR APPROVED LENDING PARTNERS

Let's find your perfect match with our quick Grants and Loans search today! It's FREE and takes less than 2mins...

Your information is confidential to us. We NEVER rent, sell or share your info. We ONLY notify you with verified financial information to meet your needs + You can unsubscribe at any time 👍🏻

This page provides general information only and should not be used or interpreted as specific advice for your individual circumstances. Please seek specific advice about your finance needs from a Certified Credit Advisor. All finance applications are assessed on the individual applicants current financial circumstances which will reflect the interest rate offered by our panel of lenders. All loan applications are subject to the lenders lending parameters, terms and conditions.

EZFinance Pty Ltd. ACN:140178383 - Australian Credit Licence Number (ACL): 392611 and it's authorised Advisors are fully qualified to give advice and assist with all/any consumer lending. EZFinance Pty Ltd is a member of AFCA. EZFinance Commercial Pty Ltd (ACN:639833604) and it's authorised advisors are fully qualified to give advice and assist with all/any Commercial / Business lending. EZFinance Commercial Pty Ltd only advise and assist with "Non-Coded" finance (as described in the NCCP act 2009) and are not a member of AFCA.

EZ Finance Pty Ltd © Copyright 2022 All Rights Reserved | Privacy Policy