Want to speak with an expert broker?

The EZ Finance Blog

The latest financial news, hints and tips for Aussie small business

Unsecured Business Loans: The Dreaded Documentation Process

You are going to need to provide documentation, applying for any sort of loan.

No matter what type of finance is being applied for, it definitely pays to be organised. Especially when you’re wearing multiple hats as a business owner.

So what is unsecured finance?

It's a type of funding in which the lender doesn’t need security. Whereas secured finance, does require asset(s) to be provided as collateral in case loan repayments are defaulted.

We go through more in our FREE Financial Survivors Guide for ABN holders you can download instantly:

Financial Survivors Guide

For Unsecured Finance - What type of documentation is needed?

Bank Statements

Usually the last twelve months, and at least a minimum of six months of bank statements must be provided.

This allows the lender to assess your cashflow, including but not limited to:

Variety of income

If your industry is B2B (business to business) then the more clients you have the stronger your financial position is likely to be. The lender wants to be satisfied with your ability to pay back the loan with interest and continue trading even in the unlikely event there is an emergency or other setbacks.

Average balance

Managing your business finances is a big one. It’s also important for lenders to see you have a buffer of funds to make additional future payments, and can meet important financial obligations such as your quarterly BAS. Your application can be declined if this cannot be proven by assessing your bank statements, or the amount or conditions you can borrow may be diminished.

Deposits

Most lenders will require, or at least prefer, a minimum of four deposits per month to prove your income is stable.

Past Commitments

Insufficient funds. Those dreaded words. A lender will want to know if there is sound reason for a borrower’s insufficient balance with any dishonoured payments.

Most recent Profit & Loss Statement and Balance sheet

The P&L balance sheet, aged payables and receivables help the lender determine the financial health of your business.

Lenders will check total revenue for the period, gross profit (ie. gross margin), net profit before tax, and also the EBITDA. (earnings before interest, taxes, depreciation, and amortisation)

In simple terms, the EBITDA refers to your total earnings i.e. net profit before interest, tax, depreciation etc. And if your business is performing consistently over a number of years, you can likely afford to borrow the same amount as the EBITDA over one year.

Regardless of having a positive EBITDA, lenders rely heavily on your balance sheet when making a final decision as to whether they’ll offer you funding.

Personal and business credit records

Particularly when applying for unsecured finance, your credit score and history plays a vital role in determining your creditworthiness. An ‘excellent’ credit score will provide you with a much better shot at securing the finance you’re seeking, at a competitive rate.

Likewise, a low credit score from late or dishonoured payments or a poor payment history could make it difficult for the lender to view your financial situation positively.

Identification

You’ll likely need to provide a minimum of 100 points of ID for verification. It is always handy to have more than not enough. This can include a driver’s licence, passport, medicare card, or any other commonly used items that can significantly prove that you are who you say you are.

Guarantor’s Info

If you are lucky enough to have a guarantor as part of your application (not at all uncommon with unsecured finance) you’ll also need the same level of ID for verification as well as any supporting documents. The guarantor’s financial situation will also need to be determined by the lender in the application process.

Cash Flow Projection

Also known as a cash flow forecast, this is a detailed document or template that will often cover the previous twelve months, broken down into monthly columns. It shows your income and expenses, and can be used to predict the future performance of your business.

Other supporting docs

Any other documentation that can prove or add to the viability of your business being healthy and trustworthy financially, will help. This includes but is not limited to:

Business Plan

Strategy Plan

Sales Orders

Contract of Work

Agreements

Anything that can help add weight to your application and support your case for finance. Bear in mind, supporting docs will hold less weight than the main documentation (bank statements, P&L, cash flow projection) but of course every little bit helps.

Secured vs Unsecured - Documentation

Unsecured finance can be much faster and simpler to apply for, since it requires less paperwork. Although it can be harder to qualify for.

On the other hand, secured finance is known for a lengthy application process involving paperwork and valuations of asset collateral. Often this can drag out to months, although it may be worth going down this path if you have the assets - and time - both of which are important to your business!

By Phil Rice

CEO EZ Finance

Like the article? Share across your favourite platform...

EXPLORE OUR LATEST BLOG POSTS

When the pandemic started in 2020, Tax Laws changed and the ATO stopped chasing debt. As the economy...

Author | Phil Rice

CEO EZ Finance

Over one-third of Australian SMEs are open to exploring their funding options with non-traditional lenders, according to a new...

Author | Phil Rice

CEO EZ Finance

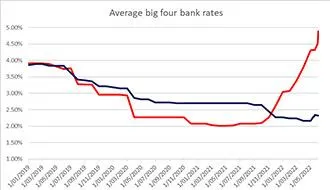

Rates are set to rise, which means businesses should secure funding sooner rather than later to lock in a great deal...

Author | Phil Rice

CEO EZ Finance

The results of a recent survey conducted by the Australian Bureau of Statistics showed financial stress in Australian households...

Author | Phil Rice

CEO EZ Finance

Corporate watchdog ASIC has urged small businesses to be vigilant about payment redirection scams after the Australian...

Author | Phil Rice

CEO EZ Finance

The Australian Small Business and Family Enterprise Ombudsman estimates the nation’s 2.3 million small businesses...

Author | Phil Rice

CEO EZ Finance

Without access to large assets to be used as collateral (secured loan) then unsecured finance could be the solution you’re...

Author | Phil Rice

CEO EZ Finance

You are going to need to provide documentation, applying for any sort of loan. No matter what type of...

Author | Phil Rice

CEO EZ Finance

Pre-Fight Considerations (Pound for Pound!) 1. Costs. It's not free to borrow money, so it is important to weigh up all...

Author | Phil Rice

CEO EZ Finance

You may already have a loan. That’s great! But whether we’re talking about commercial or residential property...

Author | Phil Rice

CEO EZ Finance

Nope! This is one of the easy ways the big banks attract customers and line they're greedy pockets. The cheapest option...

Author | Phil Rice

CEO EZ Finance

A strong theme is emerging from two consecutive years of Small Business Owner research according to various studies...

Author | Phil Rice

CEO EZ Finance

WE HELP BUSINESSES LIKE YOURS FIND FUNDING EVERY DAY!

A FEW OF OUR APPROVED LENDING PARTNERS

Let's find your perfect match with our quick Grants and Loans search today! It's FREE and takes less than 2mins...

Your information is confidential to us. We NEVER rent, sell or share your info. We ONLY notify you with verified financial information to meet your needs + You can unsubscribe at any time 👍🏻

This page provides general information only and should not be used or interpreted as specific advice for your individual circumstances. Please seek specific advice about your finance needs from a Certified Credit Advisor. All finance applications are assessed on the individual applicants current financial circumstances which will reflect the interest rate offered by our panel of lenders. All loan applications are subject to the lenders lending parameters, terms and conditions.

EZFinance Pty Ltd. ACN:140178383 - Australian Credit Licence Number (ACL): 392611 and it's authorised Advisors are fully qualified to give advice and assist with all/any consumer lending. EZFinance Pty Ltd is a member of AFCA. EZFinance Commercial Pty Ltd (ACN:639833604) and it's authorised advisors are fully qualified to give advice and assist with all/any Commercial / Business lending. EZFinance Commercial Pty Ltd only advise and assist with "Non-Coded" finance (as described in the NCCP act 2009) and are not a member of AFCA.

EZ Finance Pty Ltd © Copyright 2022 All Rights Reserved | Privacy Policy