Want to speak with an expert broker?

The EZ Finance Blog

The latest financial news, hints and tips for Aussie small business

Diverse Business Financing Options for SME's

Over one-third of Australian SMEs are open to exploring their funding options with non-traditional lenders, according to a new report.

More than one-third of small and medium-sized enterprises (SMEs) across Australia could be soon veering away from traditional banks, according to new findings released by FICO.

This data is derived from an RFI Global analysis of two years’ worth of SME Banking Council surveys, which included responses from 508 Australian SMEs.

According to the results, 38 per cent of the Australian SMEs said they would consider alternative or non-traditional lenders in the future.

The same data also noted that, as of December 2021, 15 per cent of these SMEs said they were interested in taking up new borrowing products over the next 12 months.

One explanation for this trend, as suggested by this report, is that SMEs were growing frustrated with the funding process of traditional banks.

As referenced in the FICO’s release, 45 per cent of Australian SMEs expressed that competitive interest rates were a top driver when choosing a lender.

Speed of access to funds (35 per cent), flexibility in repayment options (32 per cent), digital banking capabilities (27 per cent) and the ease and speed of the application experience (24 per cent) were also listed as key decision factors for SMEs.

FICO senior director of decision management solutions in Asia Pacific Aashish Sharma said that the COVID-19 pandemic put a “sudden, massive burden on SMEs, globally” and that they didn’t believe the banks did enough to assist them over this period.

Australia’s SMEs have made it clear that should they require financial support in 2022, they are less optimistic about getting it from their main banks. SMEs account for more than 97 per cent of all businesses in Australia, and contribute around $418 billion to Australia’s GDP, equivalent to over 32 per cent of Australia’s total economy.

According to the Australian Small Business and Family Enterprise Ombudsman’s Small Business Counts December 2020 report, small businesses accounted for between 97.4 per cent and 98.4 per cent of all Australian businesses.

At EZ Finance, we have access to more banks, Lenders and products than almost anyone else in the market, which not only increases financing options, but also hugely increases your chances or a real finance solution. Get the finance you need today, for tomorrow!

By Phil Rice

CEO EZ Finance

Like the article? Share across your favourite platform...

EXPLORE OUR LATEST BLOG POSTS

When the pandemic started in 2020, Tax Laws changed and the ATO stopped chasing debt. As the economy...

Author | Phil Rice

CEO EZ Finance

Over one-third of Australian SMEs are open to exploring their funding options with non-traditional lenders, according to a new...

Author | Phil Rice

CEO EZ Finance

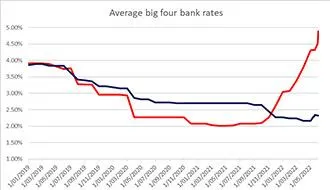

Rates are set to rise, which means businesses should secure funding sooner rather than later to lock in a great deal...

Author | Phil Rice

CEO EZ Finance

The results of a recent survey conducted by the Australian Bureau of Statistics showed financial stress in Australian households...

Author | Phil Rice

CEO EZ Finance

Corporate watchdog ASIC has urged small businesses to be vigilant about payment redirection scams after the Australian...

Author | Phil Rice

CEO EZ Finance

The Australian Small Business and Family Enterprise Ombudsman estimates the nation’s 2.3 million small businesses...

Author | Phil Rice

CEO EZ Finance

Without access to large assets to be used as collateral (secured loan) then unsecured finance could be the solution you’re...

Author | Phil Rice

CEO EZ Finance

You are going to need to provide documentation, applying for any sort of loan. No matter what type of...

Author | Phil Rice

CEO EZ Finance

Pre-Fight Considerations (Pound for Pound!) 1. Costs. It's not free to borrow money, so it is important to weigh up all...

Author | Phil Rice

CEO EZ Finance

You may already have a loan. That’s great! But whether we’re talking about commercial or residential property...

Author | Phil Rice

CEO EZ Finance

Nope! This is one of the easy ways the big banks attract customers and line they're greedy pockets. The cheapest option...

Author | Phil Rice

CEO EZ Finance

A strong theme is emerging from two consecutive years of Small Business Owner research according to various studies...

Author | Phil Rice

CEO EZ Finance

WE HELP BUSINESSES LIKE YOURS FIND FUNDING EVERY DAY!

A FEW OF OUR APPROVED LENDING PARTNERS

Let's find your perfect match with our quick Grants and Loans search today! It's FREE and takes less than 2mins...

Your information is confidential to us. We NEVER rent, sell or share your info. We ONLY notify you with verified financial information to meet your needs + You can unsubscribe at any time 👍🏻

This page provides general information only and should not be used or interpreted as specific advice for your individual circumstances. Please seek specific advice about your finance needs from a Certified Credit Advisor. All finance applications are assessed on the individual applicants current financial circumstances which will reflect the interest rate offered by our panel of lenders. All loan applications are subject to the lenders lending parameters, terms and conditions.

EZFinance Pty Ltd. ACN:140178383 - Australian Credit Licence Number (ACL): 392611 and it's authorised Advisors are fully qualified to give advice and assist with all/any consumer lending. EZFinance Pty Ltd is a member of AFCA. EZFinance Commercial Pty Ltd (ACN:639833604) and it's authorised advisors are fully qualified to give advice and assist with all/any Commercial / Business lending. EZFinance Commercial Pty Ltd only advise and assist with "Non-Coded" finance (as described in the NCCP act 2009) and are not a member of AFCA.

EZ Finance Pty Ltd © Copyright 2022 All Rights Reserved | Privacy Policy